Every Ramadhan, the most common topic and a topic that always made us feel uncertain about it - Zakat.

Muslims know the benefit of paying Zakat and its importance to pay when it's due but, there are always the same questions asked every year.

- Does my child's account need to pay zakat?

- Does my property, which is not used for Business Purposes, need to pay Zakat?

- How about my car, stamp and coin collection of value, do I need to pay zakat for that?

- How do I calculate it if I have many bank accounts and investment accounts?

- & many more.

Before Ramadhan kicks in this year, let us revisit our understanding of Zakat matters and build our confidence by recap-ing the calculations!

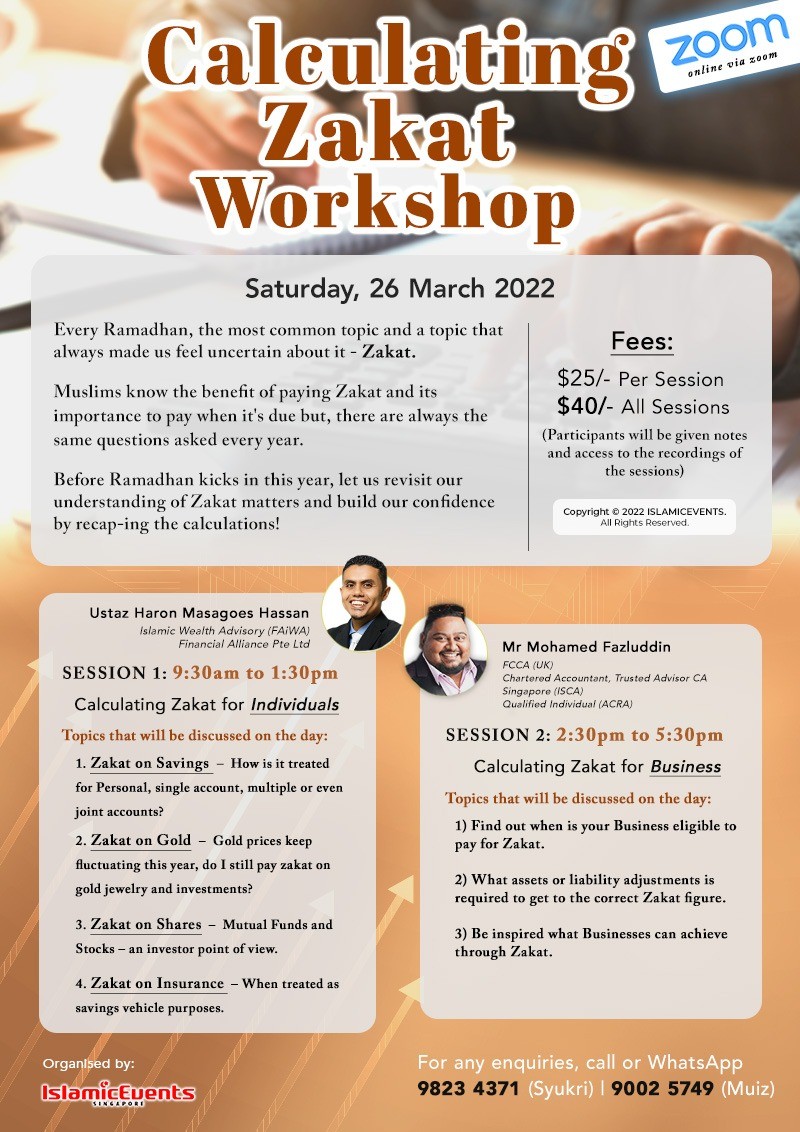

1st Session: Calculating Zakat for Individuals

Ustaz Haron Masagoes Hassan

Ustaz Haron Masagoes Hassan presently is the deputy head and internal shariah advisor for the Islamic Wealth Advisory (FAiWA) division within Financial Alliance Pte Ltd. In his role, he works closely with FAIWA's external shariah advisor, Prof Dr Akram Laldin of ISRA, Malaysia. Haron also has completed the Shariah Advisor Workshop by PERGAS (Association of Religious Islamic Scholars Singapore) which was conducted by Dr Zaharuddin Abdul Rahman.

Topics that will be discussed on that day:

1. Zakat on Savings – How is it treated for Personal, Single, Multiple or even Joint Accounts?

2. Zakat on Gold – Gold prices keep fluctuating this year, do I still pay Zakat on gold jewellery and investments?

3. Zakat on Shares – Mutual Funds and Stocks – an investor point of view.

4. Zakat on Insurance – When treated for savings vehicle purposes.

2nd Session: Calculating Zakat for Business

This will not apply if you are not a business owner.

This year, for the first time, we have added one more session for this purpose...

Unlike Zakat for an individual, which consists of Savings, Gold, Investments and Insurance, the calculations for Zakat for Business are different.

In Business, there are many different elements that a business owner needs to account for. For example, part of the money earned may belong to Suppliers, who are not paid yet. Part of the money may belong to employees' salaries and the cost of running operations and the list goes on.

So does Zakat On Business be calculated based on what is earned or ‘Revenue' or is it just based on ‘Net Profits'?

Answer is Neither.

That is why it is important for the business owner to understand basic business accounting.

For example terms such as revenue, COGS, gross profit, operating expenses and finally net profit and net profit after tax. Furthermore there are ‘Assets' and ‘Liabilities' that are required to be adjusted

For a business that is starting out, the owner also needs to understand when their HAUL starts?

What is HAUL?

This is the beginning of the business assets or current Net profits ( In Malay, it's called ‘Untung Bersih' ) and Business Savings / Reserves reaching the minimum NISAB value.

In other words, a business may not even be qualified to pay Zakat due to not meeting the NISAB value in the beginning. As the business grows, we as Muslims, need to take note of the timeline and be wary as we are accountable for such matters on Judgment day.

Let's not look at punishment as a reason to pay Zakat. Ask any Business Owners who have paid zakat before. They will tell you of miracles and blessings that you can't imagine and in many situations - they told us they are even willing to pay more.

To explain about Zakat in Business we have invited a certified Muslim Accountant to run through with you how the calculations will be done.

- Chartered Accountant, Trusted Advisor

- Qualified Individual (ACRA)

Mr Mohamed Fazluddin has over 20 years of experience in the accounting industry and business. He is also a fellow member of ACCA (FCCA, 10 years in recognition), CA Singapore (ISCA), Registered Filing Agent ACRA and has received Awards from Malay Chambers of Commerce.

This session is Moderated by:

Fadzuli Wahab

- Co-founder Islamicevents.sg

If you do understand how to fill up the form, please proceed. For most of us without an accounting background or having the numbers at our fingertips, this can be quite a daunting task.

For Business Owners, we would advise you to attend both sessions to learn about your individual and business Zakat responsibilities.

- Registered participants will be invited into the Zoom session.

- Zoom links and details will be given a day before, by Zohor.

Day/Date: 26 March 2022

Time: 1st session: 9.30am to 1.30pm ( Calculating Zakat for Individuals )

2nd session: 2.30pm to 5.30pm ( Calculating Zakat for Business )

Fees:

Session 1 ( Calculating Zakat for Individuals ) - $25 per pax

Session 2 ( Calculating Zakat for Business ) - $25 per pax

To attend both sessions - $40 per pax

- Full Payments are to be made before the Workshop starts.

- NO REFUND for participants that fail to attend the Course. Ensure you can commit to the course timings.

- Participants will be given Notes. You will have to download from the link given nearer to the course dates. The organizer has the right to make changes to the schedule or cancel the course. Participants will be informed in advance of changes.

Bank Transfer / Debit Card / Paypal / PayNow/ Paylah

Step 1: Choose the quantity

Step 2: Fill in your details

Step 3: Choose your mode of payment and proceed with payment.

How to Register? Our HOTLINE @ 9002 5749 or 9823 4371 operates during office hours. Office operating hours are from Monday to Friday, 10.30am to 6.30pm.

Sat, 26 March 2022, 9:30 am - 5:30pm | English

Sat, 26 March 2022, 9:30 am - 5:30pm | English Online

Online  Calculating, Zakat, Workshop, Haul, How, to, Business, Profits, Revenue

Calculating, Zakat, Workshop, Haul, How, to, Business, Profits, Revenue Organisers

Organisers IslamicEvents.SG

IslamicEvents.SG Speakers

Speakers Fadzuli Wahab

Fadzuli Wahab Ustaz Haron Masagoes Hassan

Ustaz Haron Masagoes Hassan Mohamed Fazluddin

Mohamed Fazluddin

Comments

Comments